In the complex realm of personal finance, one pivotal aspect with significant implications is the deductibility of mortgage interest. For homeowners, unraveling the intricacies of this financial tool can open doors to various benefits.

This comprehensive guide is crafted to illuminate the nuances of mortgage interest deductibility, empowering you with the insights needed to make informed decisions on your journey of homeownership.

Deciphering the Basics of Mortgage Interest Deductibility

To initiate this exploration, a fundamental understanding of mortgage interest deductibility is paramount. We will delve into IRS guidelines, decoding what qualifies as deductible mortgage interest, and identify the types of loans falling within this category.

This section lays the groundwork for unraveling the potential financial advantages associated with homeownership.

Revealing Tax Benefits Tied to Mortgage Interest Deductibility

Having established the foundational knowledge, let’s uncover the tax benefits linked to mortgage interest deductibility. We will explore how this deduction translates into tangible savings on your annual tax bill, creating a genuine incentive for homeownership.

Real-life examples and scenarios will be presented, providing a clear picture of the impact of deducting mortgage interest and illustrating potential financial gains.

Understanding Qualifying Criteria and Limitations

While the allure of deducting mortgage interest is appealing, it’s crucial to be cognizant of the qualifying criteria and limitations set by the IRS. This section will guide you through the eligibility requirements, ensuring a clear understanding of the prerequisites for claiming this deduction.

Moreover, we will explore any imposed limitations, offering a comprehensive perspective on the scope and boundaries associated with mortgage interest deductibility.

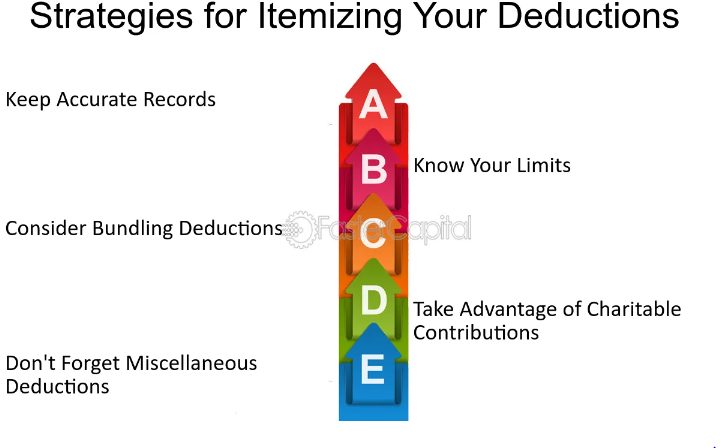

Strategic Planning for Optimizing Mortgage Interest Deductions

Armed with knowledge about the deductibility of mortgage interest, it’s time to delve into strategic planning techniques. From optimizing loan structures to considering refinancing options, we’ll discuss proactive measures homeowners can take to maximize their deductions.

This section aims to empower you with practical insights, facilitating informed decisions aligned with your financial goals.

Conclusion:

Your Informed Journey in Homeownership Finances

As we conclude this exploration into the deductibility of mortgage interest, you now possess a comprehensive understanding of its implications on your financial landscape.

Equipped with knowledge about basics, tax benefits, qualifying criteria, and strategic planning, you are better prepared to navigate the intricate world of homeownership.

“Unlocking the Potential: Exploring the Deductibility of Mortgage Interest” serves as your compass in making informed decisions, ensuring you harness the full financial potential of your home.

Categories: Lifestyle

Leave a Reply